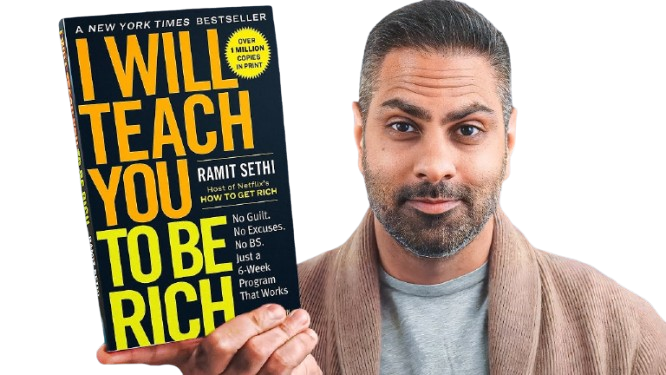

In our last episode discussing Ramit Sethi’s book, we received a bunch of questions about the author himself. This proves that our audience was intrigued by his book’s lessons, so we combined all those questions to provide answers for our listeners.

Ramit Sethi is known for his no-nonsense approach to personal finance, focusing on practical systems that help people manage their money without feeling deprived. His philosophy is all about designing a “rich life” based on conscious spending, automation, and long-term investing. If you’re looking to build wealth without tracking every penny, this guide breaks down some of his most valuable lessons.

Ramit Sethi follows a set of 10 money rules that guide his financial decisions:

- Always have one year of emergency savings.

- Save 10% of your income and invest it wisely.

- Pay off all credit cards in full every month.

- Invest for the long term (don’t chase trends).

- Never question spending on health, books, or personal development.

- Buy the best and keep it for years.

- Prioritize experiences over material things.

- Negotiate your salary (at least once).

- Earn money through side businesses or investments.

- Give generously to causes you believe in.

These rules help create a structured approach to wealth-building while still allowing for guilt-free spending on things that truly matter.

Is Ramit Sethi a Millionaire?

Yes, Ramit Sethi is a self-made millionaire. He started learning about personal finance in college, where he experimented with investing his scholarship money. Over the years, he built his wealth through smart investing, his best-selling books, and multiple online businesses. Today, he runs a thriving business that helps people automate their finances and build long-term wealth.

What Are Ramit Sethi’s Credentials?

Ramit Sethi has an educational background in psychology and technology. He studied at Stanford University, where he earned degrees in Science, Technology & Society and Psychology. His background in human behavior helps him take a unique approach to personal finance—focusing on psychology and money habits rather than just numbers. He has been featured in publications like The New York Times, The Wall Street Journal, and Fortune for his expertise in personal finance.

How Does Ramit Sethi Make Money?

Ramit Sethi makes money through multiple revenue streams, including:

- Book sales – His bestselling book, I Will Teach You to Be Rich, continues to generate income.

- Online courses – He offers premium programs on personal finance, business, and personal development.

- Coaching and consulting – He works with individuals and couples to optimize their financial lives.

- Speaking engagements – He is a sought-after speaker at finance and self-improvement conferences.

- Investments – Ramit follows his own advice by investing for long-term growth.

What Kind of Book Is I Will Teach You to Be Rich?

I Will Teach You to Be Rich is a personal finance book that focuses on practical, action-based strategies rather than strict budgeting. It teaches readers how to automate their money, invest wisely, and design a financial system that works for them. Unlike traditional finance books that emphasize extreme frugality, Ramit’s approach allows for spending on things you love while still building wealth.

How Many Copies of I Will Teach You to Be Rich Have Been Sold?

Since its first release, I Will Teach You to Be Rich has sold over 1 million copies worldwide. Its popularity has led to multiple updated editions, helping thousands of readers take control of their finances.

Bonus: Money Advice for Couples

If you’re in a relationship, financial conversations can be challenging. Ramit Sethi also wrote Money for Couples, a book that provides a framework for building financial trust, navigating spending differences, and setting shared money goals. It’s an essential read for couples who want to avoid money-related conflicts.

Final Thoughts

Ramit Sethi’s philosophy is simple: set up automated systems, spend guilt-free on what you love, and invest for the long term. Whether you’re just starting your financial journey or looking to optimize your money habits, his advice can help you create a stress-free and fulfilling financial life.